TRUSTED BY TOP FIRMS AROUND THE WORLD

Selling your business can be brutal.

You only flirt with the idea of selling your business until the doctor calls with bad news, the business takes a dip, or the "perfect" buyer shows up with an offer that seems too good to be true.

Your priorities change overnight, and you scramble to get a deal done. Endless questions. Months of negotiations. And in the end you get a disappointing offer that's nowhere near what you'd imagined.

If you're really lucky and your deal closes, you get to watch the new owners tear apart everything you spent your life building. Your employees get fired. Your customers leave. Your legacy crumbles.

We know this nightmare because we’ve seen it play out for too many good business owners.

But the story doesn’t have to end that way. When you invest in preparation, you control the outcome. You can stop the chaos before it starts and ensure that when you walk away, you do it on your terms, at your price, with your legacy intact.

Why owners choose us over big M&A firms?

Big firms treat exits like transactions. We treat it like the most important decision of your life.

Us

Proactively involved

Active partner in value creation

Flexible timeline optimizing outcome

Warm buyer relationships

Custom buyer materials

Executive-led process

De-risked exit process

Higher probability of closing

Them

Reactively engaged

No interest in value creation

Rigid timeline that optimizes speed

Spray & pray buyer outreach

Cookie cutter documents & decks

Analyst-driven process

Creative "storytelling" exit process

Higher rate of broken deals

We're backed by world-class owners & operators.

Our Growth Advisors play an active role in strategizing and coaching our clients to build stronger, more valuable businesses.

_edited.jpg)

Keith Henry

Former CEO of Windsor Mold Group

_edited.jpg)

Nick Wagner

Founder of Premise LED

_edited.jpg)

Shelley Wishart

Founder of Orchard International

_edited.jpg)

Rizwan Somji

Former CEO of Cymax

David Yundt

Former Executive of McKesson, UPS & Plexxus

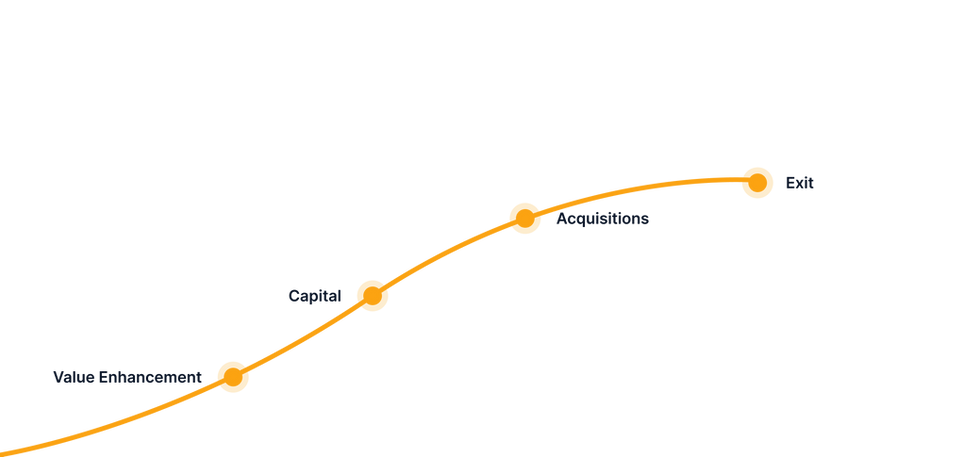

Our process gives you

clarity, control & certainty.

1

ASSESSMENT

Face the truth about value, risks and gaps

2

FOUNDATION

Lock in fundamentals that anchor valuations

3

GROWTH

Turn potential into demonstrated success

4

TRANSITION

Exit on your terms to a steward of your legacy

Start with radical clarity from our Strategic Value Assessment.

.png)

Most owners have no idea what their business is actually worth and what's holding it back. Financial gaps, operational risks, and value leaks stay trapped behind outdated teams, processes and systems until its too late.

Our Strategic Value Assessment fixes that. It's a McKinsey-grade diagnostic built for founders who want an honest view of their business ahead of a transition and motivated to make the changes necessary to maximize value and protect what matters most.

It is designed to:

-

Provide an Exit Readiness Score across 20 categories

-

Reveal business risks and trapped value

-

Expose deal-killers that quietly sabotage success

-

Share real insights from active buyers in your space

-

Deliver a clear roadmap to maximize value

We love working with companies that have:

Unique Edge

A brand, capability or technology buyers value.

Strong Leadership

Management with accountability, culture & grit.

Proven Profitability

$1M+ EBITDA with resilience.

Frequently Asked Questions.

Knowledge is power. Every great exit starts with better questions.

Sooner than you think. Time is either your greatest ally or your most expensive mistake. The truth is, exits aren’t won at the closing table. They’re won years earlier, in the decisions that build the foundation of your business. Owners who start early don’t just get higher multiples; they get to design their destiny and turn fear into leverage, chaos into order, and uncertainty into choice. By the time you're prepared for the transition, you’re not hoping they’ll see your value - you’re showing them who’s in control.

Attention is not opportunity. Every buyer who calls you already knows what they want: your business at their price, on their terms. They’re professionals at earning your trust and rushing you into a quick sale. You get one shot at doing it right but they take a hundred a year. That’s not a fair fight.

We come in to tip the balance. Before a single conversation with buyers begins, we go under the hood of your business and help you eliminate everything that drags value down: margin leaks, customer concentration, operational bottlenecks, weak reporting, founder dependency, disorganized financials, you name it. We rebuild the structure so when buyers look in, they see efficiency, scalability, and proof - not risk. Then, when the market sees a company that’s clean, confident, and bulletproof, the dynamic shifts. Buyers stop circling for a deal. They start competing for the privilege to own what you’ve built.

We’re not deal pushers. We’re value builders. Most brokers show up when the story’s already written. They list your company, cross their fingers, and hope someone bites. We show up long before that, when the plot still has time to change. We dive in, diagnose what’s quietly eroding value, and rebuild the business so it’s bulletproof by the time buyers arrive.

We bring the precision of bankers, the insight of operators, and the loyalty of true partners. Where others chase transactions, we design transformations. We don’t wait for opportunity to knock. We engineer it. That’s why we close deals others can’t even start. Because when you build something extraordinary, you don’t have to sell it. The market comes for it.

That’s when it matters most. The best exits aren’t built in the year you sell - they’re built in the years before. Buyers reward proof not potential and proof takes time. Time to clean up the numbers, strengthen leadership, expand margins, and show the business can thrive without you.

Most owners wait until they’re tired. That’s when leverage disappears, urgency replaces strategy, and they start playing defense with their own legacy. The smart ones start early. They treat “a few years away” as their advantage because it gives them space to shape the story buyers will one day pay a premium for.

If you’re serious about walking away on your terms, this is where it starts. Let’s make the time you have work for you.